Fisherman vs. Arrowhead maker - What do small business owners need to know about economics?1/4/2022 By Ron Burgess for MicroGiants

Many small business owners tend to think of the economy as something so big that they don’t study it. Over time they certainly understand the effect of changing interest rates, taxes and government interference in their particular industry, but still, that tends to be the extent. So without opening this large can of worms, here are my thoughts about some important basics of economics. I was the same. At first, I watched my industry and the general economy, for protective measures to my businesses. As I branched out to other industries, I spent more time reviewing what I thought I had learned in business school about economics (John Maynard Kayne’s and John Kenneth Galbreath) only to realize that the text books that I studied were written by men who I now see as “progressive.” In other words (and very generally), they believe that government has a large role to play in shaping the economy. Everywhere I looked, I saw government intervention in my business. Certainly safety is an important part of government’s role. It can influence the economy and stifle small business, yet we all want safe working conditions and generally safety in our lives. So we are willing to give up something for safety. Most of us are willing to pay a little more for electricity to keep miners safe and gas explosions from happening. That small cost barely tips our notion of energy value. But today, many, many other laws and regulations affect the economic welfare of small business. This, in some part, is due to the influence of the post-depression economics of the economists mentioned. If a problem presents itself, let the bureaucrats fix it. As a result, the bureaucracy has grown many times larger than the depression era, and hundreds of times larger than our founding fathers would even conceive of for a “free” people. So I began my quest to better understand exactly what economics are, and how we came to this place. The story of economics starts way back when two people liked what each had made, hunted or grown, and wanted to trade. Each had different skills, geography or natural resources. So each could benefit from the trade. Bartering, say, fish for arrowheads, required a discovery of sorts on price. The skilled arrowhead maker, knew how many arrowheads he could make a day. The fisherman knew how many fish he could catch each day. The arrowhead craftsman may have been the only one for miles around, while everyone locally could fish just as well as the next. So, depending on how badly the fisherman needed arrowheads, he might have traded more fish on one day than on another because he had more competition. The arrowhead maker also knew that he could make a better trade in the next village, so he wanted more fish for fewer arrowheads. Together they bartered a price that satisfied both, and a trade was made! This example explains most of what micro-economics is. We usually describe it as supply and demand. As a concept, it is deceptively simple, yet it has some very complex twists and turns. For instance, if the price of fish gets higher than the arrowhead maker likes, he may simply trade for a squirrel. In this case, a squirrel (or opossum, rat or dog for that matter) are all substitutes for the fish. The first time this happened of course the fisherman realized that he was really also in competition with hunters of all kinds. But it goes further. If all meat is too high for the arrowhead maker, or he develops a taste for bread, or even Mead (a fermented drink at least 9,000 years old). So, the fisherman must keep his prices competitive with all food. This substitution relationship is key to keeping prices and values in line. Based on this wide variety of options, two people can each determine their own value for each object, and together if they come to a transaction, they both benefit. Of course each can also customize their offerings to make them different and more desirable for the next trading session. The fisherman may smoke the fish using his own special hickory wood, making it ready to eat and perhaps more valuable. The arrowhead maker may add better notches for securing it to an arrow. We all do this today. We call it an improvement and try to brand it as our own. “Let’s go over and trade for some of Otzi’s smoked fish for dinner tonight.” Otzi’s Hickory Smoked Fish is born. A few millennia later, a Scot named Adam Smith began to build on a professor’s (Francis Hutchinson) thoughts in “political economy” and eventually wrote the landmark book in economics. I learned that pure economics do not involve much government at all. Notice how our two traders got along without government overview? He stated (among many other thoughts) that two people (traders) who are looking out for themselves in a purchase, can both be satisfied on quality, price, and service when they agree to a transaction. In other words, if they look out for themselves, they can find the best trading solutions based simply on self-interest. Many critics have twisted this to be selfish interest, but it is not the same. Only the buyer can determine if they can or should pay a certain price for something. The town council, state government or even the federal government cannot possibly watch each and every transaction to determine what the value of anything is. Yet governments try to do this all the time and constantly. Adam Smith recognized by simply watching transactions in the local market between merchants and buyers, that they each came to an agreed value on their own, base on supply, demand and substitution, and the amount of money (or time) the buyer had. Milton Freedman expanded and confirmed this concept in modern times. Each person has a different value for his time based on the supply and demand his work. So the value is different for every item and every person. When a price is posted, in a free country, you can either buy it or reject it based on your own determination of value. This ingenious system was discovered not invented. Adam Smith and Otzi both simply used logic and common sense to make the trade happen. They were mostly aware of how many substitute options the other trader had and made the price according to the value of his own time. In other words, his own productivity. Realizing this, each tried to work harder or longer to increase their own production value. When Otzi’s wife, Ayla said she needed a new cooking bowl, Otzi would be out fishing late into the night to catch more fish. He then said, “Ayla, you’re going to have help me smoke all the fish, I’m out of time and working my fingers to the bone.” The first family business was born! Who knows after the children were put to work they may have even hired an employee. And what is the lesson that applies directly to your business? First, make products that are valuable to customers. Differentiate them with service, quality or low price. If you can, brand them to take advantage of reputation and expectations. This increases value too. (See more about this concept on the Burgess Value Diamond in this MicroGiants blog in the Tools Category). Second, always work to find ways to increase quality and decrease production cost. While inflation tends to increase costs, the point here is to increase your productivity without increasing your time. Otzi used his family, but hopefully he also built a larger smoker for more fish at the same time. He may have also found a better way to use less wood and increase the confined smoke more effectively. Finally, if you are inclined, try reading Adam Smith’s “An Inquiry into the Nature and Causes of the Wealth of Nations” (1776). This was published just in time for our founding fathers to read before they wrote the US Constitution. These principles were built into our government with the attempt to keep government mostly out of economics. Economics is mostly simple, but made difficult by macro measurement techniques and those wishing who think they can outthink the nature’s economy. In is pure form it takes care of itself. ---- Want to know more about Adam Smith and Milton Friedman? Check out this excellent video. www.youtube.com/watch?v=w91Mlp7T5r4&t=2505s

0 Comments

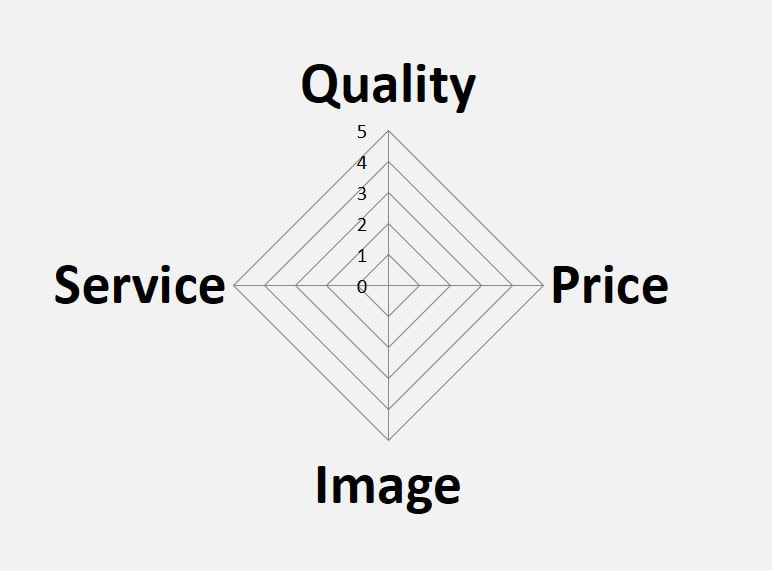

This article discusses the use of the Value Diamond as a tool for estimating perceived value of a company or product compared with competition. Ron Burgess The Burgess Value Diamond of Customer Perceived Value is a model to help evaluate how customers compare one company (or product) with competitors. It was developed by Ron Burgess, who constructed it as a way to help clients improve and grow business over 30 years working with business owners. The concept is based on a marketing approach that customers ultimately shape company value, based on their buying behaviors. Buying behaviors are driven based on Perceived Value. Getting Started on a Strategic Plan Small business owners are many times “just too busy” to start and complete a comprehensive strategic plan. It is easy to criticize them for not taking the time, except it is many times true that to keep the business going, the owners need to work in the business and rarely have time to work on the business. Doing regular involved strategy sessions is seen as an exercise that can greatly increase the total value of a business. But time, knowledge of the process, and lack of other managers in a business can fall to the owner alone. While good planning can happen in this scenario, it still falls behind daily demands, but can also miss the valuable input from employees and a realistic look at competitors, external threats, and opportunities. Very small businesses also lack the cash to get outside help from professionals. The Value Diamond can bridge that gap, by providing simple, low time commitment insight into starting a strategy. It works as a first step, and or a periodic snapshot on areas that need improvement in your business. Perceived Value A customer’s -perceived value is constructed from four elements; perceived value, perceived service, price, and perceived image (or branding). In the world of marketing, customer perception is more important than reality, because only buying behavior affects revenue. So for these reasons, the use of other models is desirable because operational issues drive margins and profits which in-turn drive business valuations. The Valuation Wheel discussed in an earlier article is a good model to look at the financial and operational aspects of valuations. Use of the Value Diamond serves as a way to compare products, services and companies, so the examination yields a priority on what aspects of operations should be focused to get the greatest benefit. Unlike the more structured approaches previously mentioned, the Value Diamond can be easily estimated by managers and sales people who are aware of competitive forces. This simple approach is completed in just a few minutes while most evaluation methods require considerable discovery before making the evaluation. This approach allows an initial quick shot of the customer’s perceived value, while encouraging more discovery and research to verify and deepen the analysis. Advanced approaches break down the four dimensions into component parts allowing greater accuracy and insight (not discussed here). The diamond is a spider chart with four dimensions, thus the “diamond”. Using a scale of 1-5 each of the dimensions (or characteristics) is scored.

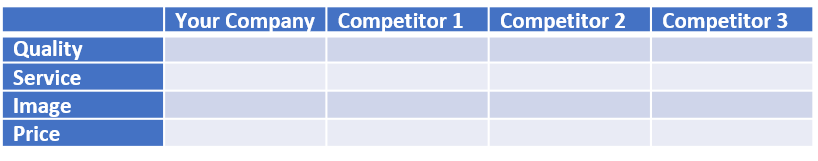

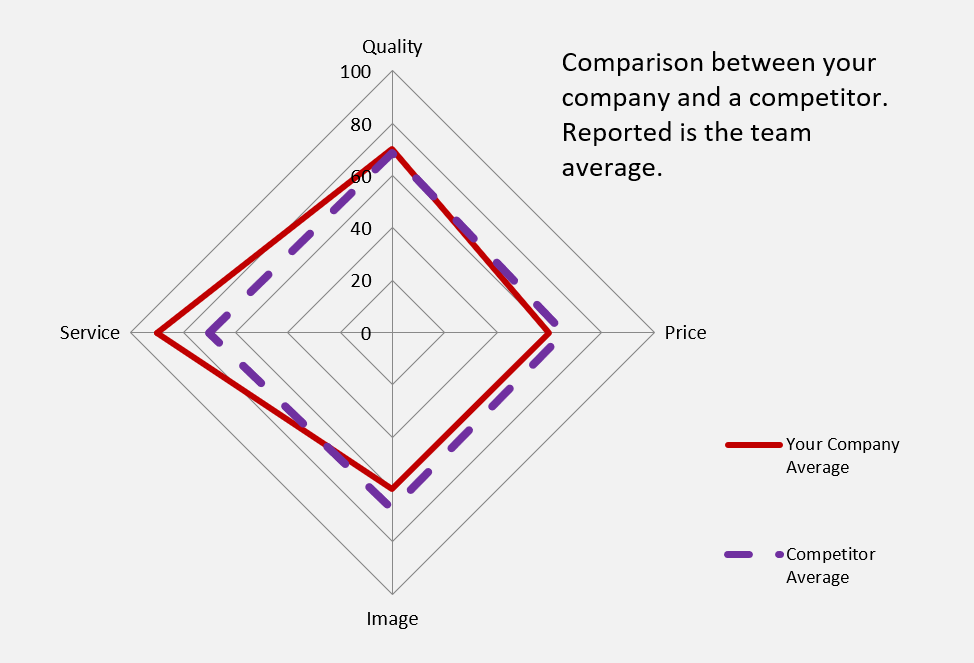

Each characteristic is scored for the company and two (or three) competitors. They can be used in a simple chart like below, or plotted on a blank Value Diamond chart that can be downloaded here. Scores between 1 and 5 are then entered into a spreadsheet and plotted using a spider chart. Quality, service and Image are scored 5 is high, and 1 is low, while price is scored the opposite; 1 is high price and 5 is low price. Note above: This image uses a scale from 0 to 100 because it is an advanced, calculated model based on outside feedback. When using the tool manually the 0-5 model seems to be less confusing, however the outcome is the same.

The gap between the subject company and competitors become the areas that need action. Note above that there is a substantial “gap” in service. Your company has a perceived advantage over the competitor in service delivered. When the quality is the same, and image is lower the real service image could be better communicated which may allow a matched price as well. Additionally, the relative gap differences can be easily evaluated to determine investments required compared to the relative value gained compared to competitors. This is a quick way to determine what issues need work first. For example, if image and quality are lagging behind competitors, it may be that improving image is much less costly than completely re-engineering a product line. While both should be of concern, with limited budget image can be helped in a short time while new engineering or a continuous improvement process would take months or years. Therefore, the priority of tasks is easily determined compared to other strategic development models. The Value Diamond is not intended to replace strategic planning but to jump start it or supplement it. It does not take into account many operational inefficiencies or HR and other administrative issues. Therefore, other models are more appropriate. However, the argument for a quick start rather a huge delayed start or an incomplete plan is a strong one. We suggest that you continue your planning process using one of the systems described by this series of articles. See the entire series Articles | Dream Big Exit by Ed Lasak, CPA. Connect on Ron Burgess | LinkedIn or MicroGiants.biz |

AuthorRon Burgess Archives

January 2022

Categories

All

|

RSS Feed

RSS Feed