|

This article discusses the use of the Value Diamond as a tool for estimating perceived value of a company or product compared with competition. Ron Burgess The Burgess Value Diamond of Customer Perceived Value is a model to help evaluate how customers compare one company (or product) with competitors. It was developed by Ron Burgess, who constructed it as a way to help clients improve and grow business over 30 years working with business owners. The concept is based on a marketing approach that customers ultimately shape company value, based on their buying behaviors. Buying behaviors are driven based on Perceived Value. Getting Started on a Strategic Plan Small business owners are many times “just too busy” to start and complete a comprehensive strategic plan. It is easy to criticize them for not taking the time, except it is many times true that to keep the business going, the owners need to work in the business and rarely have time to work on the business. Doing regular involved strategy sessions is seen as an exercise that can greatly increase the total value of a business. But time, knowledge of the process, and lack of other managers in a business can fall to the owner alone. While good planning can happen in this scenario, it still falls behind daily demands, but can also miss the valuable input from employees and a realistic look at competitors, external threats, and opportunities. Very small businesses also lack the cash to get outside help from professionals. The Value Diamond can bridge that gap, by providing simple, low time commitment insight into starting a strategy. It works as a first step, and or a periodic snapshot on areas that need improvement in your business. Perceived Value A customer’s -perceived value is constructed from four elements; perceived value, perceived service, price, and perceived image (or branding). In the world of marketing, customer perception is more important than reality, because only buying behavior affects revenue. So for these reasons, the use of other models is desirable because operational issues drive margins and profits which in-turn drive business valuations. The Valuation Wheel discussed in an earlier article is a good model to look at the financial and operational aspects of valuations. Use of the Value Diamond serves as a way to compare products, services and companies, so the examination yields a priority on what aspects of operations should be focused to get the greatest benefit. Unlike the more structured approaches previously mentioned, the Value Diamond can be easily estimated by managers and sales people who are aware of competitive forces. This simple approach is completed in just a few minutes while most evaluation methods require considerable discovery before making the evaluation. This approach allows an initial quick shot of the customer’s perceived value, while encouraging more discovery and research to verify and deepen the analysis. Advanced approaches break down the four dimensions into component parts allowing greater accuracy and insight (not discussed here). The diamond is a spider chart with four dimensions, thus the “diamond”. Using a scale of 1-5 each of the dimensions (or characteristics) is scored.

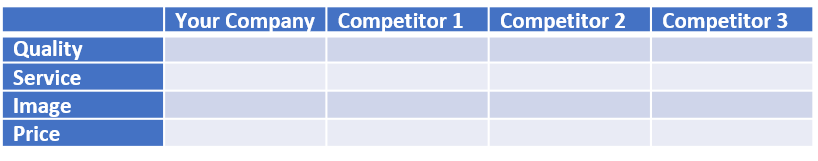

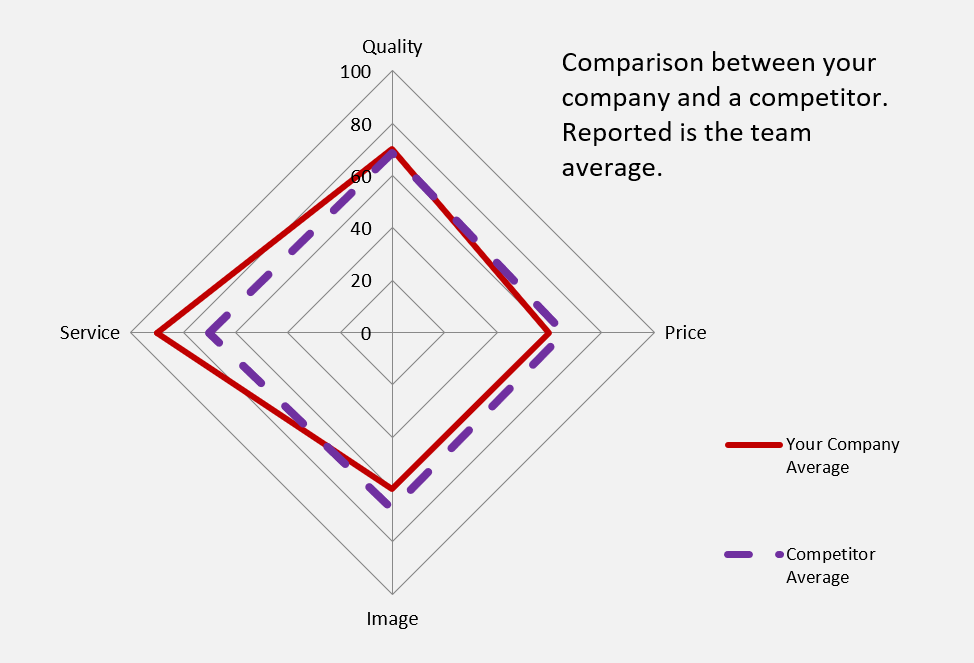

Each characteristic is scored for the company and two (or three) competitors. They can be used in a simple chart like below, or plotted on a blank Value Diamond chart that can be downloaded here. Scores between 1 and 5 are then entered into a spreadsheet and plotted using a spider chart. Quality, service and Image are scored 5 is high, and 1 is low, while price is scored the opposite; 1 is high price and 5 is low price. Note above: This image uses a scale from 0 to 100 because it is an advanced, calculated model based on outside feedback. When using the tool manually the 0-5 model seems to be less confusing, however the outcome is the same.

The gap between the subject company and competitors become the areas that need action. Note above that there is a substantial “gap” in service. Your company has a perceived advantage over the competitor in service delivered. When the quality is the same, and image is lower the real service image could be better communicated which may allow a matched price as well. Additionally, the relative gap differences can be easily evaluated to determine investments required compared to the relative value gained compared to competitors. This is a quick way to determine what issues need work first. For example, if image and quality are lagging behind competitors, it may be that improving image is much less costly than completely re-engineering a product line. While both should be of concern, with limited budget image can be helped in a short time while new engineering or a continuous improvement process would take months or years. Therefore, the priority of tasks is easily determined compared to other strategic development models. The Value Diamond is not intended to replace strategic planning but to jump start it or supplement it. It does not take into account many operational inefficiencies or HR and other administrative issues. Therefore, other models are more appropriate. However, the argument for a quick start rather a huge delayed start or an incomplete plan is a strong one. We suggest that you continue your planning process using one of the systems described by this series of articles. See the entire series Articles | Dream Big Exit by Ed Lasak, CPA. Connect on Ron Burgess | LinkedIn or MicroGiants.biz

0 Comments

Once marketing positioning and a market niche is well understood the products or services are launched, a new business lives or dies based on cash. Just like a bad injury, a cash bleed-out can kill you.

The concept is very simple, but surprisingly this is one of the top reasons otherwise successful businesses die. Worse, it happens when success causes fast growth, just as it happens because you don't have the revenue to cover costs. The other big surprise for most business people (and their CPA's) is that regular financial statements do not deal with cash flow. Sure if you ask for one, you will typically get a "Statement of Cash Position," which is NOT a cash flow projection even though it is related. A cash flow forecast is a plan of when cash will come into the business (spendable money) and when you will need to pay for expenses, payroll and taxes. It involves some basic estimates about sales, payments from accounts receivable, accounts payable schedule and various other cash transactions such as loans, paybacks, tax over payments, and cash spending on new assets. One reason most accountants don't like to do cash flow projections is that they hate to forecast. Accounting is a precise instrument of what happened. It does not naturally like estimates or forecasting. For most business owners setting up a cash flow plan or forecast should be done by conservative planning; by themselves. Below is a basic start up cash flow plan. Basic: 1. Estimate revenue based on the last 6 months of cash receipts from sales. Use a moving average so if you are growing, this will create a trend for sales. If you have no sales experience yet, the forecast will have to come from your niche market planning assumptions. 2. Estimate average expenses for each month to be paid in that month. 2. b If you buy goods to resell, you must calculate an "Open-to-buy" plan* 3. Calculate payroll for the next several months by week 4. Add bank balance for the day you are starting the calculation. 5. Plan when you will pay for extraordinary purchases such as equipment. Place 1. on the revenue line in a spreadsheet. Add 4. to this number in the first column Subtract 2, 3, and 5 This will provide a very basic cash flow plan. Update this weekly by replacing estimates and forecasts with the real numbers. Notice if your cash balance is trending down or up; if down, start early to make the changes to each component so you don't run out of cash. Plan to pay all bills on time, faithfully. * An open-to-buy plan is a forecast on how much inventory you will need to keep your sales growing. Some industries like fashion retailing can require buying 10 months out, so this becomes a big issue if you miss-buy. Since few people know how to do this, many businesses over buy, which puts a huge pressure on paying bills. This results in mark-downs, whcih puts pressure on profits. More on open-to-buy in a future blog post. |

AuthorRon Burgess Archives

January 2022

Categories

All

|

RSS Feed

RSS Feed